Plastic Bag Making Machines for Sale in Pretoria

Plastic Bag Making M

Plastic recycling machines for Cape Town businesses are industrial systems that convert post-consumer and post-industrial plastic waste into reusable pellets and reprocessed material, reducing disposal costs and supplying circular feedstock for local manufacturing. This article explains the machine categories, the materials that can be recycled effectively in the Western Cape, and the step-by-step process from waste collection to pellet production while highlighting economic and sustainability benefits. Businesses reading this will learn which machines suit different waste streams, how pelletizing and granulation work, and what to consider when evaluating payback and compliance in Cape Town. The guide also integrates practical examples of commercial equipment used at each stage and outlines how targeted after-sales service and warranty terms reduce deployment risk. Finally, the article maps local regulatory drivers such as Extended Producer Responsibility (EPR) and current market trends that influence equipment selection and project timelines for Cape Town operations.

Plastic processing machinery available to Cape Town businesses includes shredders and granulators for size reduction, washing systems for contamination removal, extrusion and pelletizing lines for melt processing, and auxiliary cooling and drying units that support downstream pellet quality. These recycling equipment categories address a range of input materials from film to rigid containers and scale from small in-plant units to full extrusion lines suitable for recycling plants. Understanding each category helps buyers choose the right capacity and footprint for their operation, and selecting compatible components ensures consistent pellet quality. Below is a concise list that defines the primary machine types and their core function for quick reference before a deeper comparison.

Primary machine types commonly used for plastic recycling in Cape Town:

These machine categories cover the core technical steps in recycling, and understanding their roles clarifies later decisions about throughput, automation and product quality. Choosing proper equipment types leads directly into more detailed capacity and material comparisons that inform purchase decisions.

Plastic pelletizing machines transform cleaned and dried plastic flakes into uniform pellets by feeding material into an extruder where heat and mechanical shear melt the polymer, forcing it through a die head that forms strands which are then cut into pellets and cooled. Key process parameters include screw design and temperature zones, which control shear and residence time to preserve polymer properties while minimizing degradation. Filtration systems and melt pumps are critical for removing contaminants and stabilizing flow, and strand pelletizers or underwater pelletizers produce different pellet surface qualities depending on downstream use. Typical industrial pelletizers emphasize precise temperature control and robust filtration to deliver consistent pellet size and low contamination, which directly affects the marketability of the recycled pellets.

These mechanical and thermal controls are central to producing high-quality recycled plastic pellets and set the stage for evaluating line capacity and expected yields in the next section that compares granulators and shredders.

| Machine Type | Typical Input Materials | Typical Output | Typical Capacity Range |

|---|---|---|---|

| Pelletizer (Extrusion + Cutting) | Washed HDPE, LDPE, PP flakes | Uniform pellets ready for reprocessing | Small: 100–500 kg/day; Industrial: 500–2,000+ kg/day |

| Granulator | Film, bottles, rigid scrap | Flakes sized for extrusion | Small in-plant: 50–300 kg/day; Industrial: 300–1,500 kg/day |

| Shredder | Bulky film bales, mixed rigid items | Coarse chips for pre-processing | 200–2,000+ kg/day depending on rotor and drive |

This comparison shows how machine selection aligns with input type and desired output; proper matching reduces downstream wear and improves pellet yield.

Industrial granulators and shredders differ primarily in feed method and reduction ratio: shredders handle bulky or baled material and excel at coarse size reduction, while granulators produce smaller, more uniform flakes suited to washing and extrusion. Key features include rotor and blade geometry, screen sizing to determine output particle size, feed systems (gravity, conveyor-fed, or chute-fed) and safety interlocks to protect operators and equipment. Maintenance considerations focus on blade access, replaceable wear parts, vibration control, and noise mitigation, which affect total cost of ownership and uptime. Performance specifications such as rotor speed and torque determine throughput and the types of plastics each unit can process reliably, and these features guide decisions between a compact in-plant granulator and a heavy-duty industrial shredder.

Understanding these operational and maintenance trade-offs helps buyers specify machines that match their material mix and production targets, which in turn impacts choices for washing and pelletizing described later.

Cape Town businesses can effectively recycle common polymers such as HDPE, LDPE, PP and PET with the right pre-processing, washing and extrusion strategies; each polymer has distinct sensitivity to contamination, melt conditions and market demand that influence equipment choice. Mapping polymer types to recommended machinery clarifies which lines yield market-grade pellets and where additional pre-treatment is needed. Below is a practical mapping to support equipment selection and expected pellet quality across typical waste streams.

| Material Type | Typical Waste Stream | Recommended Machine Types | Expected Pellet Quality |

|---|---|---|---|

| HDPE | Bottles, jerrycans, piping scrap | Granulator → Washing → Extruder + Pelletizer | High mechanical properties; suitable for molded goods |

| LDPE | Agricultural and shopping film | Film granulator → Friction/Hot washing → Extruder + Strand pelletizer | Moderate quality; best for non-critical extrusion or blown film |

| PP | Rigid containers, injection scrap | Granulator → Washing → Extruder + Pelletizer | Suitable for automotive and household non-food applications |

| PET | Bottles and clear containers | Bottle flaker → Hot washing → SSP (if required) → Pelletizer | Typically requires advanced drying; food-grade needs additional treatment |

HDPE is valuable because recycled HDPE pellets retain mechanical strength, chemical resistance and versatility, making them suitable for local manufacturers producing items such as containers, piping, and molded consumer goods; consistent pellet quality helps reduce reliance on virgin resin. Processing HDPE requires controlled extrusion temperatures, robust melt filtration to remove contaminants, and reliable moisture control to preserve mechanical properties, with expected yields depending on contamination levels and separation efficiency. Local manufacturers benefit from lower raw-material logistics costs and improved supply chain circularity when using PCR HDPE, and integrating a pelletizing line can supply in-house production with predictable material specifications. These advantages enhance competitiveness for Cape Town producers while reducing landfill contributions and transportation emissions.

Local HDPE recycling initiatives therefore strengthen both environmental outcomes and local industrial resilience, which leads naturally into choices for film and PP handling challenges next.

LDPE film and PP film streams present handling challenges due to thinness, high contamination rates and variable density, requiring specialized film feeders, low-speed granulators and flotation or friction washing systems to separate contaminants effectively. Recommended solutions combine film-specific granulators with air-separation systems, dedicated film conveyors and multi-stage washing that may include friction washers, hot-water tanks and continuous dryers to reduce moisture before extrusion. For PP, robust melting and filtration help tolerate higher contamination, while LDPE often benefits from tighter process control and sometimes co-extrusion stabilization to produce acceptable pellets. Pre-treatment measures — such as manual sorting, delabeling and targeted bale preparation — significantly improve downstream pellet quality and lower production costs by reducing extruder wear and filtration load.

These targeted equipment combinations and pre-processing tactics enable reliable recycling of thin-film and mixed PP waste streams, feeding into the extrusion and pelletizing steps explained next.

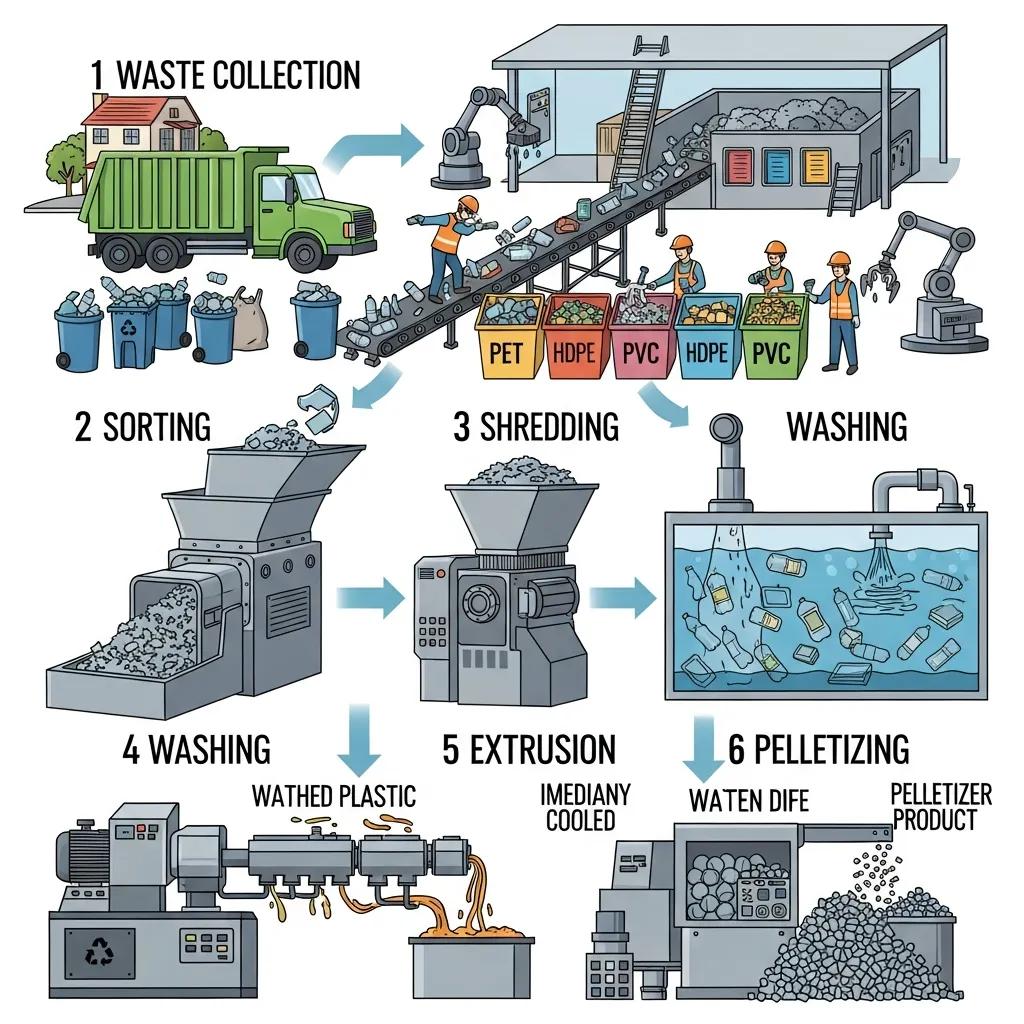

The recycling workflow converts collected plastic into sellable pellets through a sequence of collection, sorting, shredding/granulating, washing and drying, extrusion with filtration and pelletizing, followed by cooling and packaging; each step controls contamination and moisture to protect melt quality. Machine selection at each stage affects throughput, energy consumption and final pellet purity, so system design typically balances capital cost with desired output quality. Below is a numbered step-by-step guide that outlines the core process stages and quality control checkpoints for operators planning a recycling line.

Follow these numbered core process steps from waste to pellet:

This ordered workflow clarifies how upstream sorting and washing quality directly influence extrusion demands and pellet marketability, and it sets the stage for examining equipment examples and automation that improve efficiency.

Sorting separates plastics by polymer and color using manual sorting, sink-float separation and optical sorters; good sorting reduces cross-contamination and boosts pellet value.

Washing ranges from coarse dry-cleaning and friction washers to hot chemical washing for heavily contaminated streams, followed by mechanical dryers and vacuum dewatering to achieve target moisture levels under extrusion thresholds. During extrusion, screw design, temperature profiling and melt filtration (screen changers or fine mesh filters) control polymer degradation and remove solid contaminants that would otherwise reduce pellet quality. Monitoring metrics such as moisture content, melt flow index and head pressure provide actionable quality control signals and help operators tune processes for consistent pellet output.

These technical checkpoints ensure the extrusion stage receives clean, dry feedstock, which is critical for predictable pellet quality and downstream acceptance by manufacturers.

Advanced technologies such as PLC automation, real-time process monitoring, improved screw geometries, melt filtration systems and energy recovery options increase throughput, reduce downtime and enhance pellet consistency in modern recycling lines. Automation provides repeatable process recipes that maintain temperature profiles and screw speeds optimized for specific polymers, while online sensors for melt pressure and moisture enable proactive adjustments that protect product quality. Enhanced filtration and degassing systems enable processing of more contaminated streams with acceptable yields, and newer screw designs focus on energy efficiency and gentle shear to minimize polymer degradation. Integrating these technologies reduces operational variability and labor intensity, improving the economic case for local recycling investment.

Greater process control and reduced operator dependency make advanced systems well-suited for Cape Town businesses seeking reliable pellet quality and predictable operating costs.

Investing in industrial recycling equipment delivers measurable commercial benefits including lower disposal costs, new revenue from pellet sales, reduced raw-material purchases by using PCR, and enhanced sustainability credentials that can unlock procurement preferences and compliance advantages. These benefits manifest as improved margins from internal material substitution and avoided landfill fees, and the exact payback depends on throughput, feedstock quality and local pellet market prices. The table below outlines common benefit categories, measurable attributes and example value ranges to support decision-making for Cape Town operations.

| Benefit | Measurable Attribute | Example Value/Range |

|---|---|---|

| Disposal cost reduction | Landfill/collection fees avoided | 10–60% cost savings depending on diversion rate |

| Pellet sale revenue | Price per tonne of PCR pellets | Varies by polymer; illustrative margins of 20–40% vs disposal costs |

| Raw material substitution | % of in-house resin replaced by PCR | 10–50% depending on product specs |

| Payback period | Months to recover CAPEX | Typical ranges: 18–48 months depending on scale and feedstock |

Diverting plastic from disposal to in-house recycling reduces fees tied to landfill and waste transport while creating feedstock that offsets purchases of virgin resin; operational steps include source segregation, bale preparation, and prioritizing high-value streams like HDPE. Implementing basic sorting and compacting at generation points increases the value of collected material and improves washing efficiency, which lowers processing costs per kilogram. Example calculations comparing per-ton disposal fees to potential pellet revenue often show quick gains when contamination is low and local pellet demand exists, and using recycled material internally multiplies savings by avoiding market price volatility for virgin resin. For operations uncertain about scale, staged implementation—starting with a granulator and washing line—captures immediate disposal savings while deferring larger-capex extrusion investments.

Practical process improvements and careful stream selection therefore drive the majority of immediate cost offsets, leading to the payback scenarios summarized next.

ROI depends on variables including daily throughput, yield after washing, local pellet prices, and capital and operating costs; conservative scenarios for small in-plant systems often project payback within 24–36 months, while larger integrated lines can show payback in 18–30 months under favorable market conditions. Key ROI drivers are stable feedstock supply, low contamination, and access to buyers for produced pellets or internal usage that replaces virgin resin purchases. Financing, leasing options and phased deployment reduce upfront barriers and allow businesses to scale capacity as demand and feedstock volumes grow. Example scenario planning should model conservative, base-case and aggressive returns using local disposal fees and estimated pellet prices to ensure realistic expectations.

Modeling these scenarios clarifies financial risk and informs procurement choices such as level of automation, filtration complexity and warranty/after-sales considerations discussed next.

Plastic Bag Machine South Africa (operating as Kingdom Machinery Co., Ltd.) offers relevant recycling equipment examples including plastic recycling machines, plastic pelletizing machines and plastic granulators that can form part of an end-to-end line in Cape Town operations. For businesses evaluating suppliers, choosing equipment with reliable delivery timelines, warranty coverage and responsive support reduces project risk and speeds time-to-production.

Plastic Bag Machine South Africa (operating as Kingdom Machinery Co., Ltd.) positions itself as a global manufacturer and supplier of plastic processing equipment with a suite of strengths designed to reduce buyer risk and support deployment. Their SERP-provided value statements include 100% final inspection with low defect rates (1–3%), two-year warranty on timer switches, strong R&D team, one-stop service (customization from concept to mass production), 16 production lines, internal laboratory with over 30 testing equipment, competitive pricing, fast delivery (samples within 3 days, bulk 15–20 days for standard machines), over 1,700 machines installed in 102 countries since 2005, and 24-hour online after-sales support. These attributes directly address common buyer concerns about quality control, customization, delivery lead times and post-sale reliability.

Positioning supplier strengths this way helps Cape Town buyers compare risk profiles across vendors and prioritize suppliers that offer fast delivery, comprehensive testing and accessible after-sales service to keep lines running smoothly.

The company emphasizes multiple buyer-facing guarantees that reduce operational risk: 100% final inspection with 1–3% defect rates for quality assurance, a two-year warranty on timer switches to protect critical controls, a strong R&D team for tailored configurations, and one-stop service that supports customization from concept to mass production. Additional selling points include 16 production lines and an internal laboratory with over 30 testing instruments to validate machine performance, competitive pricing that can lower capital expenditure, fast delivery times for samples and bulk orders, a global installation footprint and 24-hour online after-sales support. Each of these features maps to buyer needs like lower downtime, faster commissioning and predictable quality control.

These explicit UVPs provide evidence for procurement teams weighing suppliers on delivery certainty and long-term support commitments.

Timely after-sales support and operator training reduce downtime, improve yields and ensure safety and compliance for recycling lines, with benefits including quicker troubleshooting, preventive maintenance schedules and access to spare parts. Standard support deliverables—such as 24-hour online technical assistance, training programs for operators and maintenance staff, and availability of wear parts—help maintain throughput and pellet quality while lowering total cost of ownership. Recommended service-level approaches include documented response-time expectations and remote support capabilities to diagnose issues quickly, which complement on-site assistance for major overhauls. Investing in supplier-led training ensures operators follow best practices for sorting, washing and extrusion, maximizing yield and preserving equipment life.

Good training and responsive support are therefore central to preserving ROI and operational continuity for Cape Town recyclers.

Regulatory drivers and market trends shaping recycling investments in Cape Town include Extended Producer Responsibility policies that shift end-of-life costs onto producers, growing demand for post-consumer recycled (PCR) content in supply chains, and municipal or provincial initiatives that may offer funding or procurement incentives for recycled materials. These forces increase demand for local recycling capacity and raise expectations for traceability, material quality and reporting. Businesses should align equipment choices and process controls with emerging requirements for PCR content and consider systems that enable traceable, auditable material flows to meet procurement specifications. The next sections look at EPR mechanics and recent regional trends to help organizations plan compliance and investment strategies.

Understanding policy and market signals helps buyers time investments and choose equipment that meets both current needs and foreseeable regulatory requirements.

Extended Producer Responsibility (EPR) assigns responsibility and sometimes financial liability for end-of-life product management to producers, encouraging investments in recycling capacity and design-for-recyclability to meet compliance targets and avoid fees. Under EPR regimes, manufacturers and brand owners may find it cost-effective to partner with recyclers or install on-site recycling to control feedstock quality and demonstrate compliance. Practical steps for businesses include auditing packaging streams, implementing source segregation, and evaluating whether in-house recycling or contracted solutions deliver better compliance economics. By shifting certain waste management costs toward producers, EPR creates stronger market demand for reliable recycling infrastructure and higher-quality PCR material.

As EPR frameworks mature, businesses that proactively improve circularity and reporting are better positioned to minimize compliance costs and capture value from recycled materials.

Recent trends show rising interest in circular-economy projects, growth in demand for PCR materials—particularly HDPE and LDPE for packaging applications—and municipal programs that prioritize diversion from landfills through collection and sorting improvements. Government and industry initiatives may include grant programs, public-private partnerships and procurement preferences that favor recycled content, creating opportunities for new recycling capacity in the Western Cape. Monitoring provincial announcements and industry associations helps equipment buyers identify potential funding windows and partnership models. Aligning machine capability with polymers prioritized by policy and market demand increases the likelihood of securing buyers for produced pellets and achieving faster payback on equipment investments.

These market and policy trends imply stronger near-term demand for HDPE, LDPE and PP recycling capacity, reinforcing the commercial case for investing in fit-for-purpose equipment.

Kingdom Machinery Co., Ltd. is a manufacturer and supplier of plastic film and plastic bag production equipment for the entire factory, including blown film machines, bag making machines, flexible printing machines, copper tube machines, recycling extruders, stretching film machines, and foaming machines.

Whatsapp:008613088651008.