Plastic Bag Making Machines for Sale in Pretoria

Plastic Bag Making M

Blown film extrusion machines convert plastic resin into continuous tubular film that is inflated, cooled, and wound for use as bags and films, and Rustenburg manufacturers and converters rely on these lines to produce common packaging formats locally. This guide explains how blown film extrusion works, compares available machine types, and outlines the practical factors buyers in Rustenburg should evaluate when selecting a line. Many small and medium converters face choices about layer count, material compatibility, output capacity, and total cost of ownership; this article offers a clear decision framework plus operational checklists to reduce uncertainty. You will find step-by-step process descriptions, a practical comparison of mono-layer and multi-layer architectures, EAV tables for quick specification matching, and pricing guidance that contrasts new and used options. The coverage also highlights service and logistics considerations specific to Rustenburg and North West province, and it includes supplier value propositions as supporting evidence for local purchasing decisions. Read on for targeted lists, specification tables, and integration tips to help you select the right blown film extruder for your product mix and production targets.

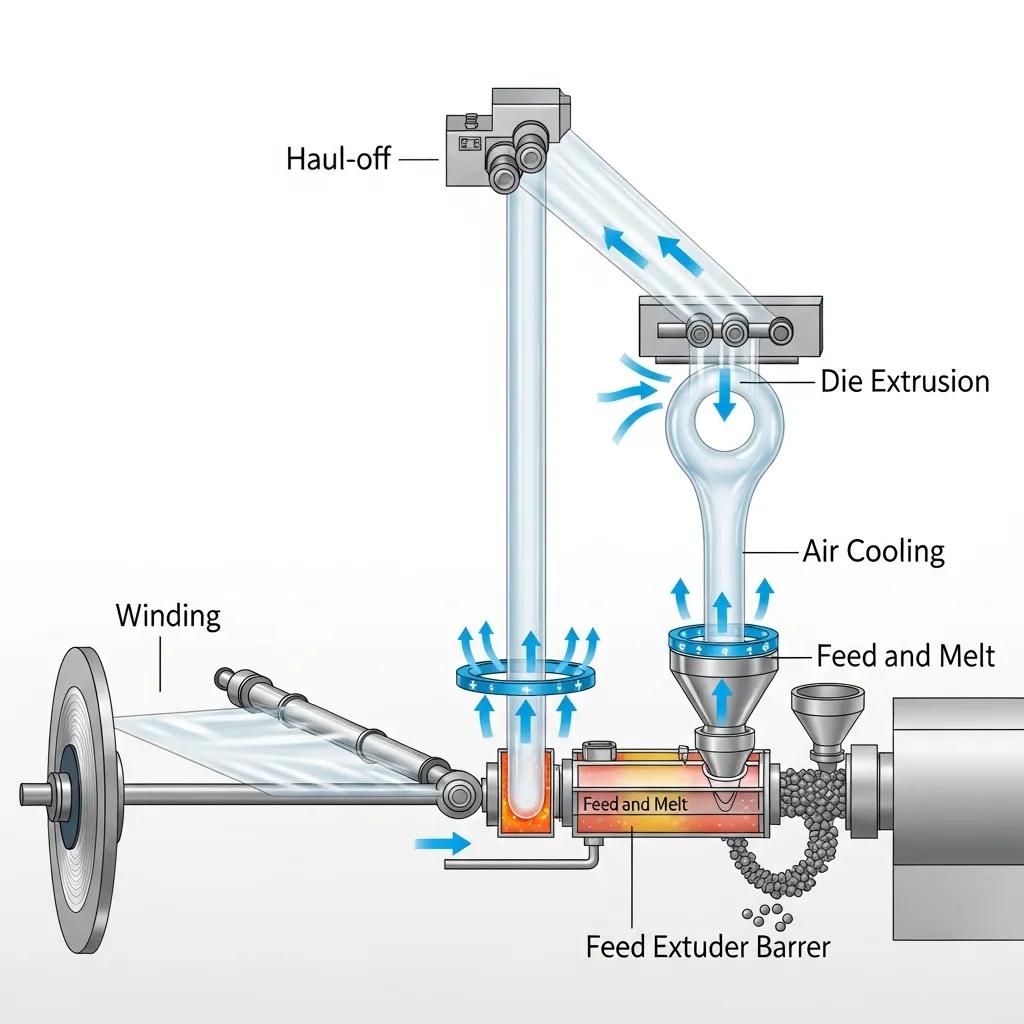

A blown film extrusion machine is a plastic extrusion system that melts polymer, forces it through an annular die, inflates the extruded tube with air to form a bubble, cools the bubble into film, and winds the finished material—this sequence turns resin into usable film and bagstock. The mechanism relies on a rotating screw and heated barrel to deliver consistent melt pressure, an air ring for controlled cooling, and a die head that determines film geometry; the result is a continuous film whose thickness and properties are controlled by haul-off speed and bubble diameter. Producing stable film reduces scrap and improves downstream converting performance, which is essential for retailers and packagers that demand consistent gauge and mechanical strength. Understanding this core process lets buyers prioritize features that directly affect product performance and yield.

The blown film process follows a concise production flow that every buyer should visualize before sizing equipment. Below is a simple, numbered process list that maps the primary production steps and clarifies where process control matters most.

These steps indicate where upgrades—such as an energy-efficient screw, advanced air ring design, or automated thickness control—produce measurable improvements in quality and cost per kilogram. Anticipating where defects originate also informs the checklist for evaluating used equipment and service agreements.

Blown film extrusion in Rustenburg operates within local constraints such as available electricity profiles, common polymer grades, and logistics for raw materials and finished goods; understanding these local factors reduces commissioning risk. Typical operations in the region process HDPE, LDPE, and LLDPE grades for shopping bags, refuse sacks, and agricultural films, and lines are often adjusted to handle fillers or regrind under controlled shear and temperature settings. Buyers should confirm power supply compatibility, spare-parts accessibility, and local technician availability prior to purchase because stable power and fast spare parts reduce downtime and scrap rates. These operational checks make the machine’s performance predictable and help maintain consistent output that matches customer specifications.

Common blown film feedstocks include HDPE for stiffness and puncture resistance, LDPE for clarity and sealability, LLDPE for toughness and stretch, and an increasing share of biodegradable polymers or blends for regulated or sustainability-minded applications. Each material requires distinct processing temperatures, shear profiles, and cooling strategies: HDPE benefits from higher melt strength and slower cooling, while LDPE favors faster cooling for clarity. Additives, slip agents, and antiblock compounds alter surface finish and processing windows, so buyers should verify extruder screw design and die capabilities to handle the chosen compounds. Choosing the right material family and additive set directly influences product properties and the appropriate extruder configuration for reliable manufacturing.

Blown film extruders available to buyers in Rustenburg range from mono-layer single-screw lines to multi-layer co-extrusion systems, including ABA and other layered architectures; each type balances cost, performance, and barrier or mechanical requirements. Mono-layer systems are simpler and less costly, producing films suitable for basic bags and films, while multi-layer co-extrusion machines (3, 5, 7 layers) enable barrier layers, tie layers, and resource-saving core layers that improve performance without increasing raw material cost proportionally. Selecting the right architecture depends on product requirements: clarity and sealability lean toward simpler lines, whereas barrier, printability, or laminated films necessitate multi-layer co-extrusion. Below is a compact comparison table to help buyers evaluate common machine types at a glance.

The following table summarizes machine types, typical output ranges, film widths, and suitable materials for common Rustenburg applications.

| Machine Type | Layers / Architecture | Typical Output (kg/h) | Typical Film Width | Suitable Materials |

|---|---|---|---|---|

| Mono-layer single-screw | 1 | 150–600 | 400–1,200 mm | HDPE, LDPE, LLDPE |

| Multi-layer co-extruder | 3 | 300–1,200 | 600–1,600 mm | HDPE, LLDPE, blends |

| 5-layer co-extrusion | 5 | 400–1,500 | 800–2,000 mm | Barrier blends, PA ties |

| 7-layer barrier line | 7 | 500–2,000 | 1,000–2,500 mm | PA/PE/Adhesives, barrier films |

Mono-layer extruders provide a low-complexity route to film production, offering simpler operation and lower capital cost while delivering acceptable mechanical properties for many bag and film types; they work well for single-material products like grocery bags and refuse sacks. Multi-layer co-extruders combine separate extruders into a common die to produce films with engineered layers for barrier, printability, and mechanical performance; this adds complexity but permits thinner gauge films with equal or better properties, improving material efficiency and finished-product performance. When deciding between them, consider product demands for barrier, print quality, and cost-per-unit: mono-layer for basic volumes, multi-layer when product differentiation or material savings justify higher upfront investment. This decision naturally leads to examining specific layer counts and their typical constructions.

Three-layer machines commonly use a sandwich structure—skin/core/skin—where the core may be a cost-saving recycled blend and skins provide surface properties for sealing and printing. Five-layer lines often incorporate tie or adhesive layers plus functional barrier or strength layers to tailor oxygen or moisture transmission rates while preserving machinability for bag making. Seven-layer lines enable complex barrier constructions (e.g., PE/adhesive/PA/adhesive/PE) for high-performance packaging that requires gas or moisture control and good printability; they maximize material efficiency but require advanced control and maintenance. Understanding these feature sets helps match product architecture with market needs and informs the decision on whether additional layer capability returns value through lower material use or better finished-product pricing.

Purchasing blown film extruders locally in Rustenburg offers practical benefits including reduced lead times, easier access to installation and commissioning support, and the potential for faster spare-parts delivery compared with distant imports. Local procurement shortens logistics, lowers inbound freight complexity, and facilitates hands-on training for operators, which accelerates ramp-up and improves first-run yields. Buyers should also expect opportunities for competitive pricing and options for refurbished equipment that meet specific production targets while preserving capital. The next subsection details the types of support buyers should confirm with suppliers to ensure smooth installation and ongoing operations.

For buyers seeking supplier support and value, Plastic Bag Machine South Africa operates as a local presence for Kingdom Machinery Co., Ltd., offering UVPs such as simple operation, perfect performance, easy maintenance, timely after-sales service, and quality assurance including final inspection metrics and limited warranty terms. This provider positions itself as a one-stop source with R&D and customization capabilities, competitive prices, multiple production lines, and fast delivery—attributes that can shorten time-to-production for Rustenburg customers and support local installation and training needs.

Expect installation and commissioning to include onsite mechanical alignment, electrical hookups, and control-panel configuration, followed by operator training that covers startup, shutdown, and routine maintenance to preserve uptime and product quality. Spare parts planning should identify long-lead items such as die components and air rings and confirm availability from local stock or a supplier’s production lines, reducing potential downtime. Service-level expectations should include response-time commitments, preventative maintenance schedules, and documentation of spare-part lists and consumables; buyers should request these as part of any purchase discussion. Verifying these service elements helps ensure the supplier can support production goals after handover.

Local suppliers or local representatives can reduce total landed cost through efficient logistics and shorter lead times, and buyers in North West province often find competitive pricing on standard lines and refurbished options that meet production needs without excessive capital outlay. Typical lead-time bands depend on machine complexity—simple mono-layer lines ship faster than multi-layer co-extruders that require die fabrication and longer testing cycles—and buyers should request explicit lead-time commitments in quotes. When considering used equipment, inspect service history, spare-part availability, and any refurbishment work; these factors materially affect lifecycle costs and overall value. Careful procurement planning and transparent quotes are essential for predictable project execution.

Choosing the right blown film extruder requires matching production capacity, material compatibility, and layer architecture to product mix while accounting for energy consumption, automation level, and expected ROI; this ensures the selected line meets both quality and cost targets. Key decision variables include desired daily output, maximum film width, range of materials to be processed, and downstream integration with bag making or printing lines. A structured evaluation avoids overspecifying capital equipment or undersizing capacity. Below is a practical EAV-style specifications table to map critical machine attributes to decision rules and recommended ranges.

The following table helps align machine specifications to buyer priorities and decision thresholds.

| Specification | Why It Matters | Recommended Range / Decision Rule |

|---|---|---|

| Output (kg/h) | Determines capacity and daily throughput | Small: 150–400; Medium: 400–900; Large: 900+ |

| Screw diameter / L:D | Controls melt throughput and homogenization | 45–75 mm screw for small/medium; 75+ mm for high output |

| Film width | Matches product line and downstream equipment | Match maximum bag width plus margins (add 10–20%) |

| Layer count | Defines product functionality (barrier/print) | 1 for basic bags; 3–7 for barrier/laminate films |

Reading machine specs—screw diameter, L/D ratio, extruder horsepower, die dimension, and max film width—lets buyers translate equipment performance into expected daily output and energy consumption. A sample sizing approach: multiply target daily finished kilograms by expected operating hours and line efficiency to determine required kg/h; then select an extruder with nominal output at or above that rate to allow headroom. Verify the extruder screw and gearbox sizing for additives or regrind handling, and ensure the die and air ring can achieve the film properties you require. This specification-centered approach reduces surprises during commissioning and aligns capital expenditure with production targets.

Energy consumption and process control directly influence operating cost and scrap rates; energy-efficient screw designs reduce specific energy per kilogram, and automated thickness control systems lower gauge variability and scrap. Automated thickness control—sometimes enhanced with closed-loop AI control—maintains gauge within tighter tolerances, improving yield and downstream machine performance while justifying higher initial cost through reduced material waste. Maintenance implications of advanced control systems include the need for trained technicians and predictable spare-part provisioning. Prioritizing energy-efficient architectures and reliable thickness control typically results in lower total cost of ownership over the machine life cycle.

Price bands for blown film extrusion machines in South Africa vary with layer capability, automation, and whether equipment is new or used; mono-layer single-screw lines sit at lower price points while multi-layer co-extruders, especially 5–7 layer barrier systems, command premium pricing. Factors driving price include the number of extruders, die complexity, automation level (PLC, thickness control), and optional accessories like in-line printers or recycling units. Below is a transparent EAV-style table that summarizes typical price bands and associated benefits so buyers can compare new versus used options while considering supplier value-adds.

| Category | Typical Price Range / Benefit | Notes on Value |

|---|---|---|

| New mono-layer | Entry-level to mid-range | Lower complexity, faster delivery |

| New multi-layer | Mid to high range | Advanced capabilities, longer lead times |

| Used / Refurbished | Reduced capital cost | Inspect condition, confirm spares & refurb history |

| Supplier value-adds | Warranty, QA, financing options | Important for risk management and time-to-market |

New machines provide the latest control systems, manufacturer warranty, and predictable lead times, while used or refurbished lines lower upfront cost but require careful mechanical and electrical inspection to mitigate lifecycle risk. A buyer checklist for used equipment should include verification of screw condition, gearbox history, die surface finish, PLC status, air ring integrity, and availability of replacement parts. Lifecycle cost comparison should factor in expected overhaul intervals, spare parts pricing, and the cost of potential downtime; sometimes modest premium for a new, energy-efficient line yields lower total cost per kilogram produced. Asking for documented quality inspection reports and refurbishment receipts reduces uncertainty when evaluating used offers.

Suppliers that offer financing or structured payment terms make capital equipment accessible while allowing operations to scale production before full payment—common approaches include lease-to-own, installment plans, or supplier-arranged finance; buyers should evaluate effective interest costs and residual obligations. Kingdom Machinery Co., Ltd., represented locally by Plastic Bag Machine South Africa, highlights supplier value propositions such as quality assurance procedures (100 percent final inspection, 1–3 percent defective product targets) and limited warranties (for select components like timer switches) that reduce acquisition risk for South African buyers. Requesting a tailored quote that includes warranty terms, QA documentation, and estimated delivery timelines helps compare total landed cost across suppliers and equipment conditions.

Blown film extruders are the front end of complete film and bag production lines where the produced film is collapsed, slit, printed, and converted into finished bags or rolls; their specifications directly determine downstream efficiency and product properties. Common applications include shopping bags, garbage bags, agricultural mulch films, and packaging films where strength, clarity, and barrier properties vary by product. Integration planning must ensure the extruder’s film width, winding tension, and web handling are compatible with flexo printing, slitting, and bag-making machinery to maintain consistent registration and reduce rework. The next sections describe typical applications and practical integration tips for end-to-end lines.

Different end products demand specific film attributes: shopping bags need balanced stiffness and sealability, refuse bags prioritize puncture resistance and thickness, agricultural films require UV stability and tensile strength, and packaging films may require barrier layers for moisture or oxygen control. Matching these product requirements to machine architecture is essential: mono-layer lines can often meet shopping and refuse bag needs, while agricultural and barrier packaging frequently require multi-layer constructions or coatings. Producers should map desired product specs—tensile strength, seal temperature, opacity—to machine capabilities during supplier selection to ensure the finished product meets market and regulatory expectations.

Successful integration of a blown film line with flexo printing and bag-making units depends on synchronization of web speed, consistent gauge control, and proper web handling to avoid registration errors and web breaks; the extruder’s winding system and tension control must match downstream equipment. Quality checkpoints such as inline thickness measurement, web edge guides, and defect detection should be placed before printing and before bag-forming to prevent waste and protect tooling. Planning integration also includes matching material surface properties (slip/antiblock) to printing needs and verifying that the film’s mechanical profile meets the converting line’s gripping, sealing, and cutting requirements. A practical integration checklist helps coordinate vendors and establish clear acceptance tests during commissioning.

For Rustenburg-based buyers seeking complete solutions, Plastic Bag Machine South Africa represents Kingdom Machinery Co., Ltd., which supplies complementary equipment such as plastic bag making machines, flexo printing options, and recycling systems—allowing buyers to source integrated lines and local after-sales service. This one-stop approach simplifies procurement and commissioning by consolidating responsibility for mechanical fit, control compatibility, and delivery logistics, supporting faster ramp-up and reducing coordination effort across multiple vendors.

Kingdom Machinery Co., Ltd. is a manufacturer and supplier of plastic film and plastic bag production equipment for the entire factory, including blown film machines, bag making machines, flexible printing machines, copper tube machines, recycling extruders, stretching film machines, and foaming machines.

Whatsapp:008613088651008.

At Kingdom Machinery Co., Ltd., we pride ourselves on being a leading manufacturer of plastic bag making machines. Our commitment to quality and innovation ensures that our customers receive the best machinery tailored to their specific production needs. By choosing us, you are partnering with a company that has established itself as a trusted name in the industry.

Our extensive range of plastic bag machinery includes options for various applications, from shopping bags to biodegradable solutions. We understand the importance of efficiency and reliability in production, which is why our machines are designed for optimal performance, ensuring your business can meet market demands effectively.

Our plastic bag machines are engineered to provide numerous advantages, including ease of operation, low maintenance costs, and high productivity rates. These features make them ideal for businesses looking to enhance their manufacturing processes while keeping operational costs low.

Additionally, our machines are equipped with advanced technology that ensures consistent quality in production. With energy-efficient designs and robust construction, our equipment not only meets but exceeds industry standards, providing you with a competitive edge in the market.

We have had the pleasure of serving over 1000 satisfied customers across various regions, each with unique needs and challenges. Our commitment to customer satisfaction is reflected in the positive feedback we receive, showcasing the effectiveness of our machines in real-world applications.

From small start-ups to large manufacturing plants, our clients have successfully integrated our machinery into their operations, leading to increased productivity and profitability. These success stories underscore our dedication to providing tailored solutions that foster growth and innovation.

As a forward-thinking manufacturer, we continuously invest in research and development to bring the latest innovations to our plastic bag machines. This commitment allows us to offer cutting-edge technology that enhances production efficiency and reduces waste.

Our innovations include features such as automated controls, real-time monitoring systems, and environmentally friendly production processes. By adopting these advancements, our clients can not only improve their operational efficiency but also align with global sustainability goals.