Plastic Bag Making Machines for Sale in Pretoria

Plastic Bag Making M

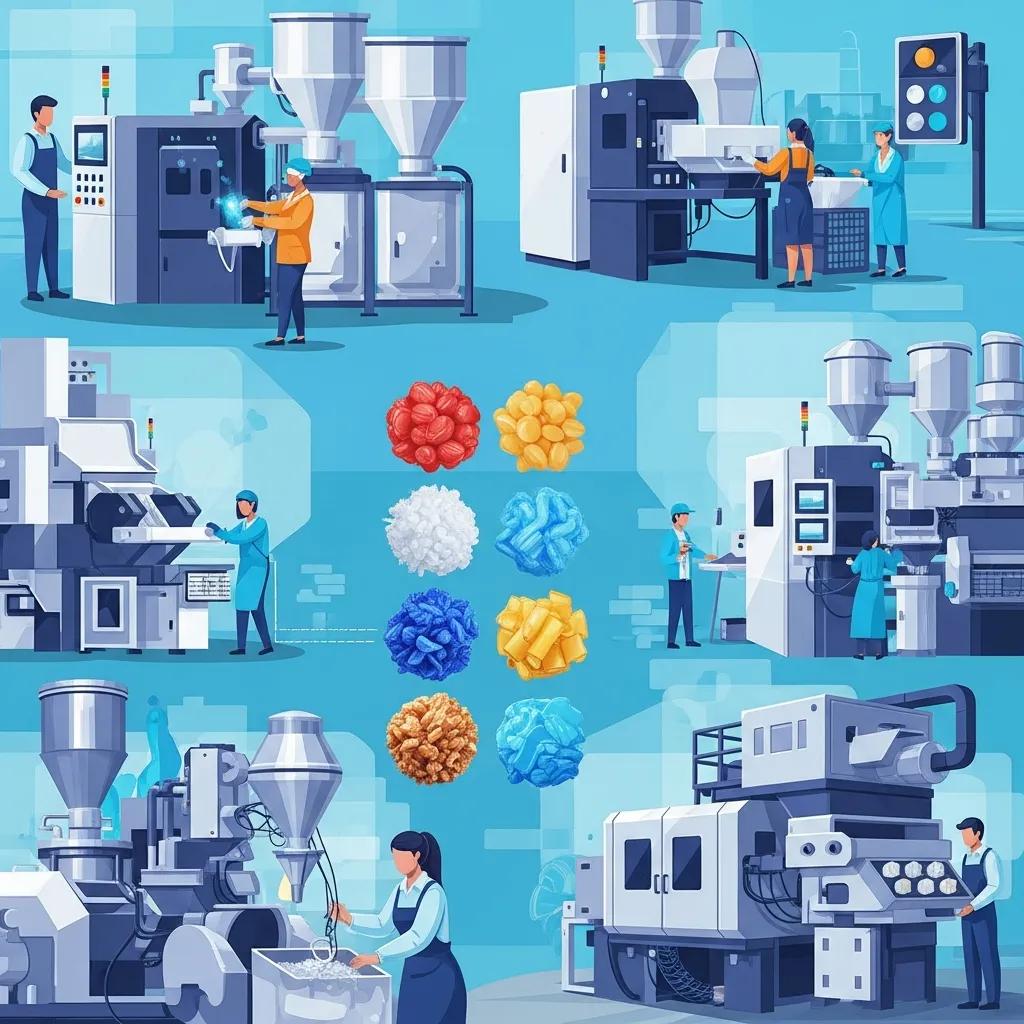

Plastic waste volumes continue to challenge industrial waste management and circular-economy goals, driving rapid innovation across mechanical, chemical, and digital recycling technologies. This article explains the newest advances—chemical depolymerization and pyrolysis, enzymatic recycling such as PETase-driven depolymerization, AI-powered plastic sorting, modern pelletizing machines, and systems-level trends like IoT and modular lines—and connects those innovations to market opportunities in 2025. Readers will learn how each approach works, where it is commercially mature or still emergent, and what operational and environmental benefits companies should expect when integrating new equipment and workflows. The following sections cover core innovations, AI sorting capabilities and enabling sensors, pelletizer advances and pellet quality, sustainability solutions including bioplastics and plastic-to-fuel options, and the top equipment trends shaping procurement decisions in South Africa and beyond. Throughout, the article highlights practical implications for plant operators, recyclers, and procurement teams evaluating recycled feedstock quality, throughput, energy use, and downstream compatibility.

In 2025, plastic recycling innovations span advanced mechanical upgrades to fully new chemical and biological processes that recover higher-value outputs from mixed and contaminated streams. These innovations improve material recovery, raise the quality of recycled pellets, and expand the types of plastics that can be economically processed; the mechanism for each varies from thermal breakdown to enzymatic depolymerization and AI-assisted separation. The key benefit is a larger pool of recyclable material being converted into feedstock suitable for manufacturing, reducing landfill and incineration. Below is a concise catalog of the primary innovations, their maturity, and why they matter to recycling operations.

The innovations listed point operators toward integrated solutions that pair sorting, washing, and pelletizing with newer chemical or enzymatic modules, which is especially relevant for packaging film and PET streams where purity and pellet quality determine market acceptance.

These innovations each reduce specific bottlenecks—contamination, mixed polymer streams, and poor pellet quality—and together they form the basis of modern, flexible recycling plants. Understanding how each innovation connects to upstream preprocessing and downstream manufacturing helps planners prioritize investments.

Chemical recycling includes thermal and chemical routes—primarily pyrolysis and depolymerization—that break polymer chains into smaller molecules such as monomers or oil-like intermediates, enabling reuse in virgin-quality plastics or as chemical feedstock. Pyrolysis thermally converts mixed plastics into pyrolysis oil that can be refined, while depolymerization targets specific polymers (e.g., PET) to recover monomers with higher purity; both approaches address streams that are difficult to recycle mechanically. The reason these processes matter is their ability to handle contaminated or multi-layer materials that mechanical lines cannot process efficiently, converting residual waste into valuable outputs instead of landfill or low-grade downcycling. However, trade-offs include energy intensity, need for stable feedstock supply, and regulatory frameworks around emissions and product acceptance.

Integration points for suppliers typically include feedstock pre-processing — shredders, washing lines, and consistent shred size — because chemical units perform best with controlled input. Considering these prerequisites helps recyclers design hybrid plants that use mechanical recycling for high-quality streams and chemical recycling for residuals, improving overall recovery rates and reducing disposal costs.

Enzymatic recycling uses specialized biocatalysts—exemplified by PETase enzymes—to selectively break polymer chains into monomers under milder conditions than many chemical methods, producing high-purity building blocks suitable for remanufacturing. The mechanism relies on enzyme-substrate specificity that allows targeted depolymerization, which reduces energy use and minimizes secondary contaminants in the recovered monomer stream. The main benefit is near-virgin monomer quality from contaminated PET, which increases market value for recycled output and supports closed-loop supply chains. Current limitations include scale-up cost, enzyme durability, and the need for consistent, pre-sorted feedstock to avoid inhibitors that reduce enzyme activity.

Pilot projects and recent studies indicate promising yields for PET streams, but large-scale commercial deployment requires cost reductions in enzyme production and robust pre-processing to meet enzyme feedstock requirements. That connection between front-end sorting and enzymatic modules underscores why investments in AI sorting and washing lines directly increase the feasibility and ROI of enzymatic recycling.

AI-powered sorting systems combine sensor technologies and machine learning to rapidly identify, classify, and separate plastic types and contaminants, increasing feedstock purity and enabling higher throughput with lower manual labour. The mechanism pairs spectral sensors or high-resolution cameras with ML classifiers that map sensor signatures to polymer types, colors, and contamination states; the specific benefit is higher purity streams that improve downstream extrusion and pellet quality while reducing rework and downtime. Typical operational improvements reported by operators include double-digit increases in sorted purity and measurable drops in manual labour hours per tonne.

Key enabling technologies include near-infrared (NIR) spectroscopy, hyperspectral imaging, camera-based computer vision with ML, and fast pneumatic or robotic ejection systems; these technologies function together to deliver real-time classification and high-speed separation. The net result is cleaner feedstock for extruders and pelletizers, which lowers melt filtration needs and reduces rejects.

AI plastic sorting relies on a combination of spectral sensors and data-driven classifiers to distinguish polymers, colors, and contamination with high accuracy and speed. NIR spectroscopy reads characteristic absorption bands to identify polymer families, hyperspectral imaging captures spatial and spectral signatures for mixed or multilayer materials, and camera plus machine learning systems infer class from visual cues and learned patterns; robotics or high-speed air jets then remove identified pieces. Typical accuracies range from the mid-80s to over 95% for common polymer classes when systems are calibrated and trained on representative local waste streams. Integration considerations include conveyor speed, sensor placement, and lighting control to ensure consistent input for the ML models.

Understanding these sensor trade-offs helps operators choose the right balance of accuracy, throughput, and capital cost for their material stream. Proper sensor selection and model training directly influence downstream equipment performance, reducing contamination that leads to extruder and pelletizer wear or product defects.

Before the comparison table, note that different sorting approaches deliver distinct business impacts — throughput, purity, and contamination reduction — which directly affect profitability and downstream processing costs.

| Sorting Technology | Typical Accuracy | Contamination Reduction | Best Use Case |

|---|---|---|---|

| NIR Spectroscopy | 85–95% | High for clear polymer families | PET, HDPE bottle streams |

| Hyperspectral Imaging | 90–98% | Very high for mixed/film streams | Multilayer films, complex packaging |

| Camera + ML Vision | 80–95% | Medium (color/shape) | Color sorting, label detection |

This comparison shows that matching sensor choice to the feedstock is essential: NIR performs well on common rigid plastics, hyperspectral systems excel with films and complex packaging, and camera-based ML provides flexible, lower-cost options for visual sorting. Choosing the proper system reduces contaminants entering extruders and pelletizers.

AI sorting systems deliver measurable improvements across purity, throughput, and labour efficiency, which collectively raise recycled pellet quality and plant economics. Operators typically see improved output purity by 10–30 percentage points, reduced manual sorting labour by similar margins, and increased effective throughput because fewer rejects or re-processing loops are required; these gains translate into lower per-tonne processing costs and higher saleable output. Downstream benefits include reduced downtime for extruders and pelletizers, longer filter life, and more consistent melt flows that produce uniform pellets. The long-term business advantage is that cleaner, higher-quality pellets attract better pricing and broader acceptance by manufacturers seeking recycled content.

Quantifying ROI requires pairing sorting accuracy metrics with local material pricing and processing costs, but the semantic triple is clear: AI sorting [entity] reduces contamination [relationship] which improves pellet quality and marketability [entity]. That cascade from sorting to market acceptance is why many modern recycling lines prioritize investing in AI-enabled separation.

After improving sorting performance, many recyclers consider how pelletizing technologies convert cleaner feedstock into high-grade pellets; the next section covers pelletizer advances and practical options.

Modern pelletizing machines have evolved to deliver better pellet morphology, density uniformity, and lower energy per tonne through mechanical improvements and cooling innovations such as water-ring and underwater pelletizers. The core mechanism involves controlled extrusion, strand or underwater cutting, and rapid cooling to lock in pellet dimensions, resulting in pellets that perform predictably in downstream processing. The impact is a direct increase in acceptance of recycled pellets by converters, higher pricing for higher-spec material, and more reliable performance in blown film and injection moulding. Selecting the right pelletizer aligns with feedstock type, desired pellet specs, and production scale.

Advances include improved screw designs and melt filtration upstream of pelletizers, energy-efficient motors, and automation for melt and die monitoring; these contribute to lower scrap rates and more consistent pellet quality. Below is a practical comparison of common pelletizer types to guide procurement decisions.

| Pelletizer Type | Throughput (relative) | Pellet Quality | Energy Use | Ideal Feedstock |

|---|---|---|---|---|

| Strand Pelletizer | Medium | Good, longer cooling time | Low–Medium | Clean, rigid plastics |

| Water-ring Pelletizer | High | Good roundness, controlled size | Medium | Film and mixed streams |

| Underwater Pelletizer | High | Excellent uniformity, dense pellets | Medium–High | Moisture-containing and variable feedstock |

This comparison shows that water-ring and underwater systems are preferable when size control and pellet roundness are critical, while strand pelletizers suit simpler, cleaner streams and lower energy budgets. Choosing the correct pelletizer reduces downstream rework and increases acceptance in closed-loop manufacturing.

Strand, water-ring, and underwater pelletizing each offer trade-offs that make them more effective in specific scenarios: strand pelletizing is simple and cost-effective for clean rigid plastics, water-ring pelletizing provides good cooling and is widely used for films, and underwater pelletizing delivers the best size control and pellet density for variable or moisture-laden feeds. The reason these differences matter is that pellet morphology directly affects melt behaviour, dosing accuracy in converters, and final part properties, which are critical for market acceptance. Practical procurement notes include matching die-face design to desired pellet length and planning for adequate cooling and drying capacity after water-based systems to prevent moisture-related defects.

Operational examples show that pairing AI sorting and robust washing with a water-ring or underwater pelletizer yields pellets suitable for higher-value film and sheet applications. Given the importance of pellet quality in circular-economy adoption, investments in advanced pelletizers often pay back through improved product pricing and reduced customer complaints.

High-quality recycled pellets supply consistent material to manufacturers, enabling closed-loop production where recycled content replaces virgin resin without compromising product performance. The mechanism is straightforward: pellets with uniform size, low contamination, and stable melt flow feed into extrusion and moulding processes with predictable parameters, thereby meeting technical specifications demanded by brand owners. The benefit is that manufacturers are more willing to specify recycled content when pellet properties are reliable, driving demand and scaling recycling economics. Examples include using high-grade recycled pellets in packaging film, where clarity and mechanical properties are essential, or in non-food-grade rigid applications where structural properties matter.

Improved pellet quality supports higher prices per tonne and broader market acceptance, which in turn incentivizes more collection and higher-quality sorting upstream — a virtuous cycle that strengthens circular supply chains. For recyclers aiming to commercialize higher-grade pellets quickly, partnering with experienced equipment suppliers for turnkey pellet-making solutions shortens the path from feedstock to market.

Following these technical explanations, practical equipment offerings can be tailored to support pellet-making and end-user specifications. Plastic Bag Machine South Africa (operating as Kingdom Machinery Co., Ltd.) supplies integrated pelletizing and plastic pellet making solutions designed for packaging film recycling, emphasizing energy efficiency, quality components, and customization. Their product options address different pelletizer needs and can be specified for targeted throughput or pellet quality; contact requests for specifications or quotes help match machine choice to feedstock and production goals.

Sustainable recycling solutions combine material innovation, recovery technologies, and policy drivers to minimize environmental impact while maximizing economic return, shaping both product design and plant architecture. The mechanisms include substituting problematic materials with recyclable alternatives, routing non-recyclable fractions into energy recovery or chemical recycling, and incentivizing upstream design changes through producer responsibility frameworks. The key outcome is systems-level gains: more circular product lifecycles, reduced raw-material extraction, and better-managed waste streams. Achieving these outcomes requires aligning sorting capacity, recycling equipment, and end-market development.

Sustainability strategies prioritize technologies that yield higher-quality recovered material with lower lifecycle emissions, and they consider the trade-offs of plastic-to-fuel approaches versus material recycling. Policymakers and brand owners increasingly demand traceable recycled content and consistent supply, which drives investment in both sorting automation and higher-spec pelletizing capacity.

Bioplastics and biodegradable alternatives occupy a nuanced role: biobased polymers may reduce fossil feedstock dependence, while biodegradable plastics address specific litter and composting challenges; however, both can cause contamination in conventional recycling streams if not properly separated. The mechanism of concern is incompatibility—biodegradable polymers can degrade product quality in mechanical recycling and confuse spectroscopic sorting systems if not labeled or separated. The benefit of these materials occurs when product design, waste collection, and dedicated industrial composting or recycling systems are coordinated; otherwise, they can undermine recycling targets.

Practical recommendations include clear labeling, dedicated collection streams for compostable materials, and investment in sorting upgrades to identify and separate bioplastics. Where separation is not feasible, alternative end-of-life routes such as chemical recycling or separate composting may be more appropriate to deliver environmental benefits.

Plastic-to-fuel technologies convert non-recyclable plastics into liquid fuels or chemical feedstocks through thermal processes like pyrolysis, offering a recovery pathway for contaminated or mixed waste that cannot be economically recycled. The mechanism recovers calorific value while diverting plastics from landfill and can be complementary to mechanical and chemical recycling strategies for residual fractions. Benefits include reduced landfill volume and potential energy recovery, but trade-offs include life-cycle emissions and the need for careful emissions control and regulatory compliance. Feedstock suitability tends to favor mixed polyolefins and heavily contaminated films rather than high-value monomer-targeted streams.

Operators must weigh plastic-to-fuel as a last-resort recovery option for residues after maximizing material recycling, integrating it into plant layouts where regulatory frameworks and local energy markets make the recovered fuels a viable output. The technology can form part of a circular strategy when combined with high-quality sorting and pelletizing that preserves the best streams for material recycling.

After exploring sustainable options and end-of-life alternatives, attention turns to equipment-level trends that support these system-wide strategies and the South African market outlook.

Equipment trends in 2025 cluster around connectivity, modularity, energy efficiency, automation, and chemistry-enabled recycling, reflecting an industry push for flexible, lower-risk investments that scale with market demand. IoT integration and predictive maintenance improve uptime and reduce service costs, modular turnkey lines enable SMEs to enter recycling with lower capital barriers, and energy-optimised drives and process control reduce operating cost per tonne. The consequence of these trends is that recycling operations can adapt more quickly to changing feedstock mixes and policy-driven demand for recycled content.

Below is a focused list of the top equipment trends and why they matter for plant operations and investors.

IoT enhances machine performance by providing real-time monitoring, predictive maintenance, and energy dashboards that let operators act before small issues escalate into costly outages. Sensors track motor vibration, temperature, throughput, and energy consumption; analytics convert those metrics into alerts and maintenance schedules, reducing downtime and spare-part inventories. The business benefit is improved uptime and lower operational expenditure due to targeted interventions rather than routine over-maintenance. Examples include vibration sensors detecting motor wear before failure and flow sensors alerting to feedstock blockages that otherwise would trigger downstream damage.

The semantic triple here is: sensor [entity] measures motor vibration [relationship] enabling predictive maintenance [entity], which reduces unplanned downtime. Such data-driven reliability increases throughput consistency and supports higher-quality pellet outputs.

Before the IoT features table, note that mapping sensors to business KPIs clarifies investment decisions — the table below links common sensors to metrics and benefits.

| Sensor | Metric Tracked | Business Benefit |

|---|---|---|

| Vibration Sensor | Motor wear | Predictive maintenance, less downtime |

| Temperature Sensor | Bearing/gear temperature | Prevents overheating, extends component life |

| Energy Meter | kWh per tonne | Identifies efficiency gains, reduces OPEX |

| Flow/Throughput Sensor | Material throughput | Optimizes process control, improves yield |

South Africa’s recycling market shows rising demand for film and PET recycling driven by stricter producer responsibility policies and brand-owner pressure for recycled content, creating procurement opportunities in packaging film lines and pellet-making equipment. Market growth projections point toward increasing installed capacity for both mechanical recycling lines and supplementary chemical or thermal recovery for residuals. Key sectors include packaging film, PET bottles, and industrial plastics where collection infrastructures are improving and regulatory incentives are encouraging investment.

Practical advice for buyers and investors is to evaluate modular, energy-efficient systems that can be upgraded with AI sorting and pelletizing modules to capture growing demand for higher-spec recycled pellets. Local market entrants benefit from turnkey suppliers who provide after-sales service and customization to match feedstock profiles and regulatory needs; these capabilities reduce deployment risk and accelerate time-to-market.

Plastic Bag Machine South Africa (operating as Kingdom Machinery Co., Ltd.) positions itself as a supplier of integrated recycling and pelletizing equipment for packaging film and related streams, offering one-stop service, customization, and after-sales support that align with the modular and service-oriented trends noted above. Interested buyers can request specifications, quotes, or arrange demonstrations to match equipment selection to local material streams and production targets.

For recyclers ready to act, clear next steps include specifying feedstock profile, target pellet specs, and integration requirements for AI sorting and IoT monitoring. The following practical checklist summarizes procurement priorities.

These actions translate technical trends into executable procurement plans that support growth and circularity in 2025.

Plastic Bag Machine South Africa (operating as Kingdom Machinery Co., Ltd.) offers tailored solutions — from water cooling plastic recycling machines to featured plastic bag and film recycling machines — emphasizing simple operation, energy efficiency, quality components, and timely after-sales service. Their market-facing capabilities include customization and warranty support to help recyclers deploy lines aligned with the trends described above, and potential customers are encouraged to request machine specifications or a quotation to evaluate fit for purpose.

For teams evaluating equipment now, prioritize solutions that combine effective AI sorting compatibility, robust pelletizing options, and IoT-enabled monitoring to maximize material recovery and long-term returns on investment. The technologies and procurement practices outlined here will help recycling operations convert industry trends into operational gains in the current market environment.

Kingdom Machinery Co., Ltd. is a manufacturer and supplier of plastic film and plastic bag production equipment for the entire factory, including blown film machines, bag making machines, flexible printing machines, copper tube machines, recycling extruders, stretching film machines, and foaming machines.

Whatsapp:008613088651008.

At Kingdom Machinery Co., Ltd., we pride ourselves on being a leading manufacturer of plastic bag making machines. Our commitment to quality and innovation ensures that our customers receive the best machinery tailored to their specific production needs. By choosing us, you are partnering with a company that has established itself as a trusted name in the industry.

Our extensive range of plastic bag machinery includes options for various applications, from shopping bags to biodegradable solutions. We understand the importance of efficiency and reliability in production, which is why our machines are designed for optimal performance, ensuring your business can meet market demands effectively.

Our plastic bag machines are engineered to provide numerous advantages, including ease of operation, low maintenance costs, and high productivity rates. These features make them ideal for businesses looking to enhance their manufacturing processes while keeping operational costs low.

Additionally, our machines are equipped with advanced technology that ensures consistent quality in production. With energy-efficient designs and robust construction, our equipment not only meets but exceeds industry standards, providing you with a competitive edge in the market.

We have had the pleasure of serving over 1000 satisfied customers across various regions, each with unique needs and challenges. Our commitment to customer satisfaction is reflected in the positive feedback we receive, showcasing the effectiveness of our machines in real-world applications.

From small start-ups to large manufacturing plants, our clients have successfully integrated our machinery into their operations, leading to increased productivity and profitability. These success stories underscore our dedication to providing tailored solutions that foster growth and innovation.

As a forward-thinking manufacturer, we continuously invest in research and development to bring the latest innovations to our plastic bag machines. This commitment allows us to offer cutting-edge technology that enhances production efficiency and reduces waste.

Our innovations include features such as automated controls, real-time monitoring systems, and environmentally friendly production processes. By adopting these advancements, our clients can not only improve their operational efficiency but also align with global sustainability goals.